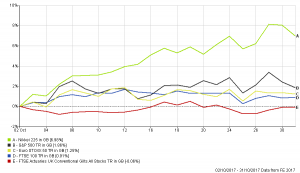

October proved to be a positive month for markets, but in reality, they simply reversed their previous month’s loss and failed to move materially higher. The performance of some of the main indices are shown below:

(all figures are based on bid to bid prices with income reinvested, in Sterling terms)

The main exception to this was Japan, where markets reached a twenty-year high on the back of President Abe’s landslide election victory, which increased expectation for a continuation of significant monetary stimulus.

This is in stark contrast to much of the remaining developed world where the rend continues to be one of policy tightening. Within Europe, the European Central Bank announced it was to halve its monthly stimulus to €30 billion and as we write this commentary the Bank of England’s Monetary Policy Committee have announced the first interest rate increase in over a decade.

America, who are further ahead in the process of winding down their stimulus (with two rate rises already this year), have announced Jerome Powell will replace Janet Yellen as Chairman of the Federal Reserve and it will be some time before we fully understand what his approach to managing the world’s largest economy will be.

Despite being cognisant of this back-drop, we must emphasise the reasons Central Banks feel confident to being the tapering process, which is that economies, generally, are beginning to look in better shape across the globe.

As a consequence we retain our positive attitude towards Equities, particularly in favour of other assets such as Bonds, remaining overweight in both UK and Globally, with an expectation for 2017’s positive momentum to carry on.

Pleasingly, this is a position that has helped all portfolios outperform relative to their Benchmarks over the year and this trend continued though October.

The Boolers Investment Comittee

Recieve our latest...

“At Boolers, you know that things will be dealt with properly and professionally. A real safe pair of hands!”

“I have always found the quality of advice, technical knowledge and level of service is second to none. ”

“Thank you to all of you for such a wonderfully smooth transaction! Hope we can do it again some time.”

“Boolers provided excellent advice when we needed it most.”

“Boolers have provided myself, family and business with pension and investment advice for over 30 years and continue to provide a high quality professional service to us all on an ongoing basis.”

“Chris Ball has been our Financial Adviser for many years and, from the start, we have been impressed with his strategic sense, his deep knowledge and his skills in helping us build our own successful retirement. He understands our aims and how to achieve them and has taken great care of us throughout. ”