September has been a slightly negative month for most developed equity markets, with the major talking point being interest rates.

Expectations of an interest rate rise within the UK are growing and comments from the Bank of England have reinforced this belief, with many expecting a rise before the end of the year. The increase in expectations has been a major factor in the continued weakness of bond markets and in particular Government debt, where the 10 year UK Gilt yield increased from 1.09% to 1.41%. We have for some time highlighted the potential risks of holding large positions in fixed interest and our moves to reduce our exposure relative to peers has been a positive contributor to our performance over the year.

The coverage around interest rates has also seen Sterling rally sinificantly against the Dollar and Euro during this month. Again, we have previously discussed the moves in Sterling and how this impacts on businesses with significant overseas earnings (positive when Sterling is falling) and during the month this has been a negative for overseas companies and UK overseas earners.

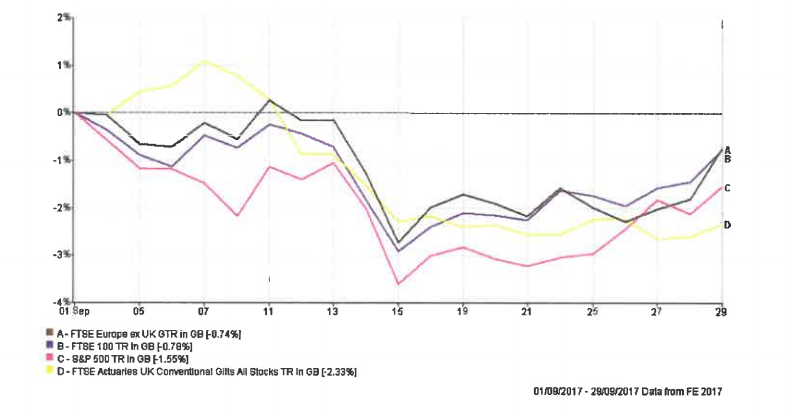

The performance of some of the main indices are highlighted in the chart below:-

Whilst equity markets have been weak over the month, the UK market, where we have retained an emphasis within portfolios, has been one of the stronger performers and this has been a positive for our relative performance compared to our peer group.

Not a great deal has changed over the month in terms of potential risks to markets (Brexit, US policy, North Korea, Chinese Growth etc). Our view remains that equities continue to provide more attractive opportunities relative to other asset classes, especially with bond yields creeping up!

We are delighted to announce that from the beginning of the month we have strengthened our investment team with the appointment of Duncan Pickering as an Investment Manager. Duncan joins the investment committee and adds further resource to our research and management capabilities.

The Boolers Investment Comittee

Recieve our latest...

“At Boolers, you know that things will be dealt with properly and professionally. A real safe pair of hands!”

“I have always found the quality of advice, technical knowledge and level of service is second to none. ”

“Thank you to all of you for such a wonderfully smooth transaction! Hope we can do it again some time.”

“Boolers provided excellent advice when we needed it most.”

“Boolers have provided myself, family and business with pension and investment advice for over 30 years and continue to provide a high quality professional service to us all on an ongoing basis.”

“Chris Ball has been our Financial Adviser for many years and, from the start, we have been impressed with his strategic sense, his deep knowledge and his skills in helping us build our own successful retirement. He understands our aims and how to achieve them and has taken great care of us throughout. ”